Credit card affiliate programs are often considered one of the best affiliate marketing opportunities for several key reasons. Besides, official credit card refer & earn programs will get you only around ₹250-₹500 per card, that too with limited earnings compared to upto ₹4050 commission per lead via these Best Credit Card Affiliate Programs. Here’s why they stand out as a highly profitable and rewarding choice for affiliates:

- Attractive Payouts: Credit card affiliate programs typically offer high commissions per conversion (i.e., when a user applies for and is approved for a credit card). These commissions can range from a few hundred to thousands of rupees (or dollars) depending on the card type, bank, and credit card features.

- Performance Bonuses: Many programs offer bonuses for reaching specific performance thresholds, such as a high volume of applications or a set number of approved credit card sign-ups, increasing potential earnings even more.

- Long-Term Value: While commissions are often one-time payouts for each successful card application, the ongoing use of credit cards by customers (such as transaction fees, annual fees, and interest charges) can provide recurring revenue for the issuing banks. Some programs reward affiliates based on these long-term customer relationships.

- Referral Bonuses: Some credit card programs also reward affiliates for referring users who continue to use the credit card for months or years, leading to a steady stream of revenue for affiliates over time.

- Strong Demand for Credit Cards: With the growing popularity of credit cards, especially among young professionals, travelers, and people looking for rewards and cashback benefits, there is consistent demand for new cards.

- Credibility of Banks and Financial Institutions: Affiliates promoting credit cards from well-known banks (such as SBI, HDFC, American Express, etc.) can benefit from the trust and credibility of these financial institutions, making it easier to convert leads into successful applications.

- Ease of Application: Most credit card applications are straightforward and easy to complete online, which helps speed up the conversion process.

- Segmented Audience: Credit cards can be tailored to specific customer segments (e.g., students, travelers, business owners, rewards-seekers), allowing affiliates to target niche audiences with specific card offerings.

- Loyalty and Rewards Programs: Many credit cards come with attractive rewards programs (cashback, points, travel perks), which appeal to users looking for value in addition to simply spending. This incentivizes affiliates to promote these cards more effectively.

- Minimal Upfront Investment: Credit card affiliate programs require little to no upfront investment for affiliates. Most affiliates just need to promote the credit card via content marketing, social media, or email campaigns. There are often no product costs or inventory concerns involved, unlike physical products.

- No Handling or Fulfillment: Affiliates don’t need to worry about shipping, returns, or customer service—everything is handled by the bank or financial institution. This allows affiliates to focus solely on driving traffic and conversions.

- Appealing Customer Benefits: Credit cards often come with enticing rewards, such as sign-up bonuses, cashback, air miles, or discounts on popular services. These benefits make the cards highly attractive to potential customers, making the affiliate’s promotional efforts easier and more effective.

- Exclusive Deals: Many credit card issuers run seasonal promotions (e.g., festive discounts, airport lounge access, or dining offers) that affiliates can leverage to increase conversions during high-demand periods.

- Widely Accepted: Credit cards are used internationally, so affiliates can target both local and global markets. Many credit card companies also offer cards with specific benefits for different regions or countries (e.g., international travel benefits, cashback in certain countries), allowing affiliates to target different markets with ease.

- Localized Campaigns: Some affiliate programs are tailored to local preferences, such as offering cards that provide benefits in specific regions (e.g., travel cards for Southeast Asia or cashback cards for India), enabling affiliates to reach localized audiences more effectively.

- Low Risk for Customers: Applying for a credit card involves minimal risk for customers, especially if they are offered a low or no-fee card initially. The barrier to entry is low, which increases the likelihood of potential applicants completing the process.

- Instant Approvals and Easy Process: Many credit card applications are approved within minutes, making it easy for customers to act quickly, which helps affiliates secure conversions faster.

- Customer Lifetime Value: Credit card companies have a significant customer lifetime value, meaning that each cardholder is likely to contribute long-term value through annual fees, transaction fees, interest charges, etc. This makes the program even more attractive to affiliates, as their referrals are likely to generate substantial ongoing income for the bank, translating into higher commissions.

- Multiple Channels of Promotion: Affiliates can promote credit cards through various marketing channels, such as:

- Content marketing (blogs, videos, and reviews)

- Social media (Instagram, Facebook, Twitter)

- Email marketing

- Paid ads (Google Ads, Facebook Ads)

- This flexibility allows affiliates to tailor their approach and maximize their reach depending on their target audience.

- Automated Tools and Support: Many credit card affiliate programs offer automated tools such as tracking links, banners, and real-time reporting. These tools help affiliates optimize their campaigns and focus on driving traffic, without needing to handle the technical aspects of campaign management.

With this head start, let’s get on to our list of 13 Best Credit Card Affiliate Programs! Before that, make a note of the following common T&Cs of these credit card affiliate programs:

- If bank needs to assist then there will be high deductions in the commission earnings

- If a user gets multiple credit cards in the same time-frame then you won’t get any commissions for most of the credit card affiliate programs in this list

- No official credit card ‘apply’ deals can be promoted except for 1-2 cards in this list

- Cashback/Incentive (if allowed) mentioned in the credit card affiliate campaigns below are the offerings from your side to users, and not from affiliate marketing platform to you (affiliates).

- Transaction Tracking Time range is from 5 mins to 7 days, Validation Time is 15-45 days (from following month), and Payout Time is 60-90 days (after validation date).

- More the EPC (earnings per click), more are the chances of conversion

- Some campaigns don’t allow multi-user accounts. This means that users who already have multiple credit cards under their name will be rejected, even if they are approved and delivered the card via these affiliate campaigns.

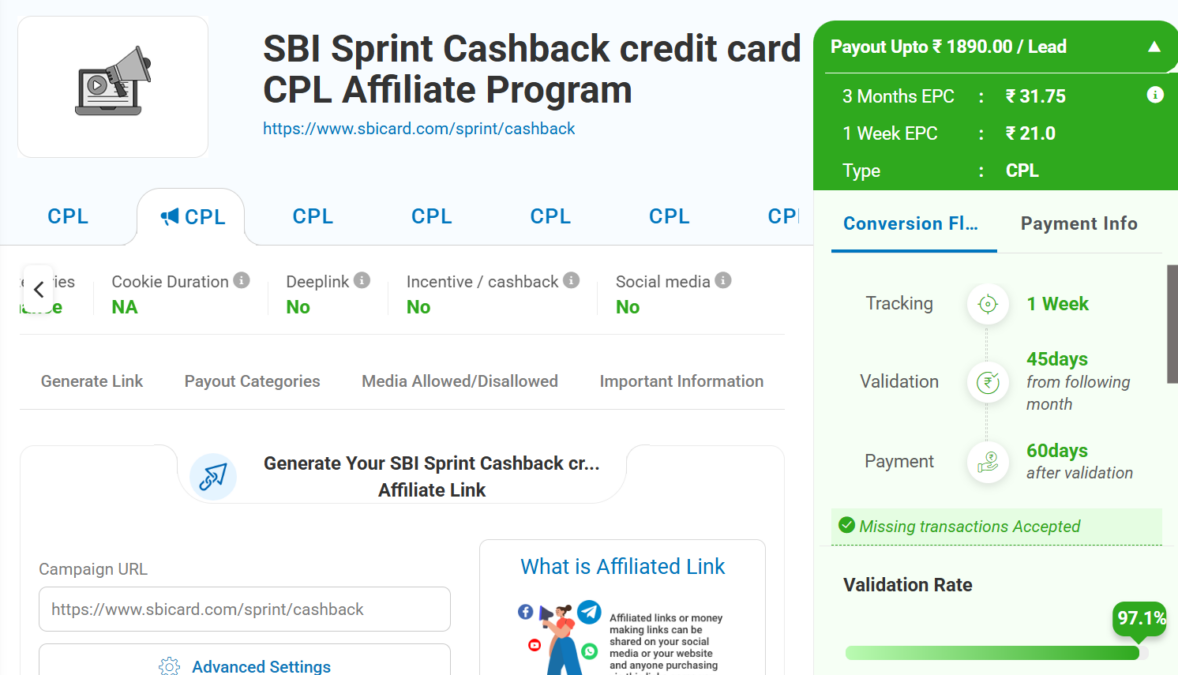

SBI Credit Card Affiliate Program: Flat ₹1,890 Commission!

This SBI Credit Card Affiliate Program is considered one of the best affiliate programs in India for several reasons, primarily due to the extensive reach of SBI (State Bank of India), the variety of credit card products it offers, good validation rate, and attractive rewards for affiliates. Here’s a closer look at why it stands out:

- SBI Credit Card Affiliate Program offers attractive commissions for every successful card application or activation. Given SBI’s popularity and credibility, the high payout potential makes this program particularly profitable.

- As one of India’s largest and most trusted banks, SBI’s name alone draws credibility and trust, helping affiliates attract users who are already familiar with the brand.

- SBI is a leading credit card issuer in India, making its credit cards highly desirable. This market dominance translates to higher conversion rates for affiliates, as users are often more inclined to choose a trusted brand like SBI.

- This bank frequently runs special promotions during festivals, shopping seasons, and big sale events (such as Diwali or Big Billion Days), which affiliates can leverage to drive higher engagement and conversions.

Commission Rates

| SBI Credit Card Variants | Commission Rate per Card (CPL) |

| SBI Prime, BPCL, BPCL Octane, SimplySave, SimplyClick, Elite, IRCTC Platinum, and SBI Cashback | ₹1,890 |

SBI Credit Card Affiliate Campaign Details

| 3 Months EPC | ₹0.26 – ₹31.75 | 1 week EPC: upto ₹21 |

| Affiliate Campaign Type | CPL (cost per lead) |

| Cookie Duration | 7 days (BPCL, BPCL Octane, IRCTC Platinum, SimplySave, Elite) |

| Validation Rate | 91.89% – 100% |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | Yes |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Banner | Yes |

Thus, the SBI Credit Card Affiliate Program combines high earning potential, extensive support, broad audience appeal, and a variety of product options, making it one of the best affiliate programs in India. Affiliates benefit from promoting a trusted brand, wide customer appeal, and lucrative commissions, making the SBI Card affiliate program an excellent choice for both new and experienced financial affiliates.

AU Bank Credit Cards Affiliate Program: upto ₹1500 Commission per Lead

Almost all AU Bank Credit Cards are participating in the AU Bank Credit Cards Affiliate Program which promises upto ₹1500 Commission Earnings per Lead.

Commission Rates

| AU Bank Credit Card Variant | Commission Rate per Lead (CPL) |

| LIT (LTF: lifetime free) | ₹1,312.50 |

| All Variants (except LIT and Insta Pay) | ₹1,500 |

AU Credit Card Affiliate Campaign Details

| 3 Months EPC | ₹0.15 |

| Affiliate Campaign Type | CPL (cost per lead) |

| Cookie Duration | NA |

| Validation Rate | 4.55% |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Tracking Time | 48 hrs |

| Validation Time | 45 Days from following month |

| Payment Time | 60 Days after Validation |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | Yes |

| Social Media | No |

| Deals & Coupons | No |

The only concern here is the low validation rate so you can highlight key benefits of AU Bank credit cards. Firstly, they have a strong focus on rewards and cashback benefits, allowing users to earn on everyday purchases like groceries, dining, and fuel. Additionally, AU Bank cards are recognized for offering zero-cost EMI options and customized credit limits, which make them appealing for big-ticket spending and financial flexibility. For frequent travelers, select cards provide airport lounge access and priority services. Plus, AU Bank emphasizes digital convenience with quick online application processes and efficient customer support, making their cards accessible and user-friendly. You can also highlight required AU Credit Card Offers and Reward Point Offerings

American Express (AMEX) Credit Cards Affiliate Program: upto ₹4050 Commission

The AMEX credit cards affiliate program has got high commission rates. Besides, it is popular for several reasons:

- High Commissions: Affiliates earn generous commissions for approved applications, especially for premium AMEX cards, which are highly sought after.

- Top-Notch Brand Reputation: AMEX is a trusted, high-end brand with global recognition, making it easier to promote to a wide audience.

- Varied Card Options: AMEX offers a range of credit cards, from no-fee options to premium cards, catering to different financial needs and demographics.

- Quality Marketing Resources: Affiliates receive well-designed marketing assets and support, making it easier to create compelling, trustworthy promotions.

- Increased Conversions: AMEX cards often come with strong incentives for users, like rewards and welcome bonuses, which improve conversion rates for affiliates.

However, its validation rate in India is less due to high fees, more CIBIL, income, and other eligibility factor requirements. Thus, it is better to use it for requirements fulfilling audiences.

Commission Rates

| AMEX Credit Card Variant | Commission Rate per Lead (CPL) |

| AMEX Platinum | ₹4,050 |

| SmartEarn | ₹945 |

| AMEX Membership Rewards | ₹1,575 |

| Platinum Travel | ₹1,837.5 |

| Platinum Reserve | ₹2,025 |

AMEX Credit Card Affiliate Campaign Details

| 3 Months EPC | NA |

| Affiliate Campaign Type | CPL (cost per lead) |

| Cookie Duration | NA |

| Validation Rate | 3.23% for AMEX SmartEarn credit card |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Tracking Time | 1 Week |

| Validation Time | 45 Days from following month |

| Payment Time | 60 Days after Validation |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

Axis Credit Card Affiliate Program: 30 Days Cookie!

The Axis Credit Card Affiliate Program is considered one of the best due to its high commission rates, cookie period, strong brand reputation, good reward point rates, and diverse card offerings tailored to various customer needs.

Affiliates benefit from a high approval rate and comprehensive marketing support, making it easier to attract and convert potential customers. Additionally, Axis Bank’s growing presence in India’s financial market further boosts affiliate success by meeting the demand for reliable credit products. This is proven by its good validation rate of 44.37%!

Commission Rates

| Axis Credit Card Variant | Commission Rate per Lead (CPL) |

| MyZone, Select, Aura, Axis Indian Oil, Indian Oil Rupay, Privilege, Health, Axis SpiceJet, Axis Samsung Signature, Axis Airtel, Rewards | ₹1,890 |

| Axis LIC Signature | ₹1,316.25 |

| Axis Flipkart | ₹1,012.50 |

| Magnus, Atlas, Axis Samsung Infinite | ₹2,700 |

| Axis LIC Platinum | ₹742.50 |

Axis Credit Card Affiliate Campaign Details

| 3 Months EPC | ₹18 | 1 Week EPC: ₹8.94 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | 30 Days |

| Validation Rate | 44.37% |

| Country | India |

| Tracking | Offline (2 Reports per week) |

| Validation Criteria | Successful credit card Activation |

| Tracking Time | NA |

| Validation Time | 45 Days from following month |

| Payment Time | 60 Days after Validation |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Banner | Yes |

HDFC Bank Credit Cards Affiliate Program: 15+ Credit Cards!

Validation Rate is very good but marketing policies are stricter (though text Emails are allowed) in this HDFC Bank Credit Cards Affiliate Program. You will get more commission for NTB (new to bank) users and it decreases from ETB (existing to bank) to ETCC (existing to credit cards) users. Besides, HDFC Credit Card Reward Point offers can be a good attraction weapon!

Qualification criteria includes males and females in the age range of 25-44 years with a salary of 2.4+ Lakhs. Besides, the HDFC Marriott Bonvoy credit card affiliate program (Hotel & Travel) will require approval from the advertiser for which you need to submit your channel/site/platform url and marketing methods.

Commission Rates

| HDFC Credit Card Variants | Commission Rates per Lead (CPL) |

| IndianOil HDFC Bank Credit Card, Freedom, Bharat Credit card, HDFC Indigo Rewards, Moneyback Plus, Business Moneyback, HDFC Swiggy, HDFC IRCTC, Shoppers Stop Regular | NTB User: ₹1,316.25 | ETB User: ₹1,144.50 ETCC User: ₹573.75 |

| Millenia, Tata Neu Infinity, Indigo Rewards XL, Diners Privilege, Shoppers Stop Black | NTB User: ₹1,603.50 | ETB & ETCC users: same as above |

| Regalia/Business Regalia, Diners Black | NTB User: ₹2,173.50 | ETB & ETCC users: same as above |

| HDFC Marriott Bonvoy | NTHCC (new to HDFC credit cards) user: ₹1267.50 (₹320 will be deducted if user goes for Physical KYC) |

HDFC Credit Cards Affiliate Campaign Details

| 3 Months EPC | ₹3.15 | 1 Week EPC: ₹3.5 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | NA |

| Validation Rate | 52.63% |

| Country | India |

| Tracking | Offline |

| Validation Criteria | First credit card transaction (₹100+) should be done within 35 days of activation | HDFC Marriott Bonvoy: 2 transactions should be done within 37 days of card activation |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Email (Text) | Yes |

HSBC Cashback Credit Card: 100% Validation Rate!

The HSBC Cashback Credit Card offers competitive cashback rates on various categories, including grocery shopping, dining, and online spending. Also, it typically offers higher cashback percentages for certain categories, which increases its attractiveness to a wide range of potential customers. Most importantly, it has a 100% Validation Rate meaning if the application is tracked then it will surely get validated for commission payout!

HSBC is one of the largest and most well-known banks globally, with a strong presence in multiple countries. This gives affiliates access to a broad audience of potential customers who are familiar with the brand and trust its services. A larger customer base also means a higher conversion rate for affiliates, which translates to more commission opportunities. However, this campaign is for India only, but still HSBC is popular among MNC corporates here.

The HSBC Cashback Credit Card Affiliate Program also offers tiered commissions or performance-based bonuses, where affiliates can earn more as they refer more customers or achieve certain targets.

While marketing, make a note that your target audience should have an Annual income of Above ₹5 lakhs, be corporate salaried, and be an existing credit card holder of Amex, Stanc, Citi, Axis, ICICI or HDFC.

Commission Rates

| HSBC Credit Card Variant | Commission Rate per Lead (CPL) |

| Cashback Card | ₹2,175 |

Affiliate Campaign Details

| 3 Months EPC | ₹4.88 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | NA |

| Validation Rate | 100% |

| Country | India (Mumbai, Pune, Bangalore, Hyderabad, New Delhi, Noida, Gurgaon, Chennai, Kolkata) |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Banner | Yes |

HSBC is a globally recognized and reputable brand. Many consumers are more likely to trust and sign up for credit cards from well-known financial institutions. This reduces the barriers to conversion, making it easier for affiliates to market the product. Moreover, due to the attractive rewards, HSBC’s reputation, and the growing trend of consumers looking for credit cards with cashback benefits, the program offers high conversion potential.

The strong reputation of HSBC can also lead to higher-quality leads (i.e., customers who are more likely to convert), improving the efficiency of affiliate marketing efforts.

Affiliates often receive access to high-quality marketing assets, such as banners, landing pages, email templates, and other promotional tools to help boost conversion rates. These tools are specifically designed to help affiliates generate interest and drive sign-ups, making the HSBC credit card affiliate marketing process smoother and more effective.

Honest Credit Card App Affiliate Program

The Honest Credit Card App Affiliate Program in Indonesia stands out as one of the best for several reasons, particularly in the context of the growing digital financial services landscape in Indonesia.

Indonesia’s rapidly growing middle class and increasing financial literacy have created a rising demand for credit cards and personal finance tools. The Honest Credit Card App offers a solution that appeals to a wide audience, including those seeking to improve their credit scores, access digital payments, or benefit from rewards programs. As financial products like credit cards become more mainstream in Indonesia, affiliates have access to a larger potential customer base.

Commission Rates

| Credit Card | Commission Rate per Acquisition (CPA) |

| Honest Credit Card App | ₹284.58 |

Affiliate Campaign Details

| 3 Months EPC | NA |

| Affiliate Campaign Type | CPI (cost per Install) & CPA (cost per Acquisition) |

| Cookie Duration | 14 days |

| Validation Rate | NA |

| Country | Indonesia |

| Tracking | Online |

| Validation Criteria | Download & Install App -> Apply -> Application Approved |

| Tracking Time | 5 mins |

| Validation Time | 30 days from following month |

| Payment Time | 60 days after Validation |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Banner | Yes |

The Honest Credit Card App is tailored specifically for Indonesian consumers, offering credit cards that cater to local needs, spending habits, and preferences. With many financial apps still focused on international markets, this localized approach gives the Honest program an edge by offering products that resonate with Indonesian users, from rewards suited to local spending patterns to easier access to credit for underserved demographics.

As Indonesia has one of the highest mobile penetration rates in Southeast Asia, the app’s mobile-first approach is particularly effective.

ICICI Bank Platinum Chip Credit Card Affiliate Program

ICICI Bank offers a wide range of credit cards, each tailored to different customer needs, from rewards and cashback to travel and lifestyle benefits. Affiliates have multiple options to promote, increasing the chance of finding the right fit for various audiences. However, currently only the ICICI Bank Platinum Chip Credit Card Affiliate Program is live. You can check out this card’s benefits here.

ICICI is one of India’s largest banks with a strong reputation, which naturally attracts potential customers and boosts conversion rates for affiliates. Many users trust ICICI’s offerings, making it easier to promote their products effectively. However, on the downside, commission rates are mediocre comparatively.

Commission Rates

| ICICI Credit Card Variant | Commission Rate per Lead (CPL) |

| ICICI Platinum Chip | ₹975 |

ICICI Platinum Chip Card Affiliate Campaign Details

| 3 Months EPC | ₹2.3 | 1 Week EPC: ₹0.92 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | 1 Day |

| Validation Rate | 92.31% |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Email (Text) | Yes |

This bank has many cards with low/no joining fees, lifetime free, high reward points, and lifestyle benefits which aligns well with market demand, such as this Platinum Chip one. The ICICI Bank Credit Card Affiliate Program also supports affiliates with timely payments and clear reporting.

1.If a customer is already using any IDFC Bank credit card, you are not eligible for commission.

7.New to Credit – Not Allowed

IDFC First Bank Credit Card Affiliate Program: upto ₹2700 Commission

To qualify for this IDFC First Bank Credit Card Affiliate Program, users should have an existing credit card (other Bank) with Min ₹50,000 credit limit and 6-month vintage. Also, they should not possess any IDFC Bank credit card. Additionally, they must have taken any type of credit earlier. Apart from these strict T&Cs, you can offer cashback incentives (except Mayura card) to increase chances of conversion.

Commission Rates

| IDFC First Credit Card Variant | Commission Rate per Lead (CPL) |

| IDFC Mayura | ₹2,700 |

| IDFC WOW | ₹337.50 |

| All Others | ₹1,012.50 |

Affiliate Campaign Details

| 3 Months EPC | ₹0.68 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | 1 day | 30 days for IDFC Mayura Card |

| Validation Rate | 100% |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | Yes | No for IDFC Mayura Card |

| Social Media | No |

| Deals & Coupons | No |

Below are some unique IDFC Bank credit card rewards & benefits you can highlight to make your IDFC First Credit Card affiliate campaign a success!

- Welcome Rewards: Many cards offer welcome bonuses in the form of reward points or cashback on specific spend categories within the first few months.

- High Reward Rates: Earn points on everyday expenses, including groceries, dining, fuel, and more. Rates vary by card but are generally competitive.

- No Expiry: Reward points on IDFC First Bank credit cards typically don’t expire, allowing cardholders flexibility in redeeming their points over time.

- Free Cash Withdrawals: IDFC First Bank credit cards allow cardholders to withdraw cash without any interest for up to 48 days, which is unique among many credit cards.

- Zero Cash Advance Fees: Unlike most banks, IDFC First Bank doesn’t charge cash advance fees, making this a standout feature for emergencies.

- Attractive Interest Rates: IDFC First Bank credit cards offer relatively lower interest rates than many other banks, starting from 0.75% per month depending on the card type and customer profile.

- Lifetime Free Cards: Some IDFC First Bank credit cards come with no annual fees, while others may waive the fee upon meeting a minimum annual spending threshold.

IndusInd Bank Credit Card Affiliate Program

IndusInd Bank credit cards stand out from other credit cards in India due to their premium offerings, unique benefits, and the flexibility they offer which is why the IndusInd Bank Credit Card Affiliate Program is a must promote!

IndusInd Bank allows cardholders to customize their rewards based on their spending habits, with options to choose reward categories such as dining, travel, and shopping. Additionally, many of their credit cards offer unlimited complimentary airport lounge access, both domestically and internationally, catering to frequent travelers.

Commission Rates

| IndusInd Credit Card Variant | Commission Rate per Lead (CPL) |

| All IndusInd Credit Cards | ₹1,050 |

Affiliate Campaign Details

| 3 Months EPC | ₹0.45 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | NA |

| Validation Rate | 100% |

| Country | India |

| Tracking | Offline (2 reports/week) |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

Select IndusInd cards also provide rewards or cashback on utility payments, such as electricity and phone bills, catering to essential monthly expenses. They also have several lifetime-free credit cards.

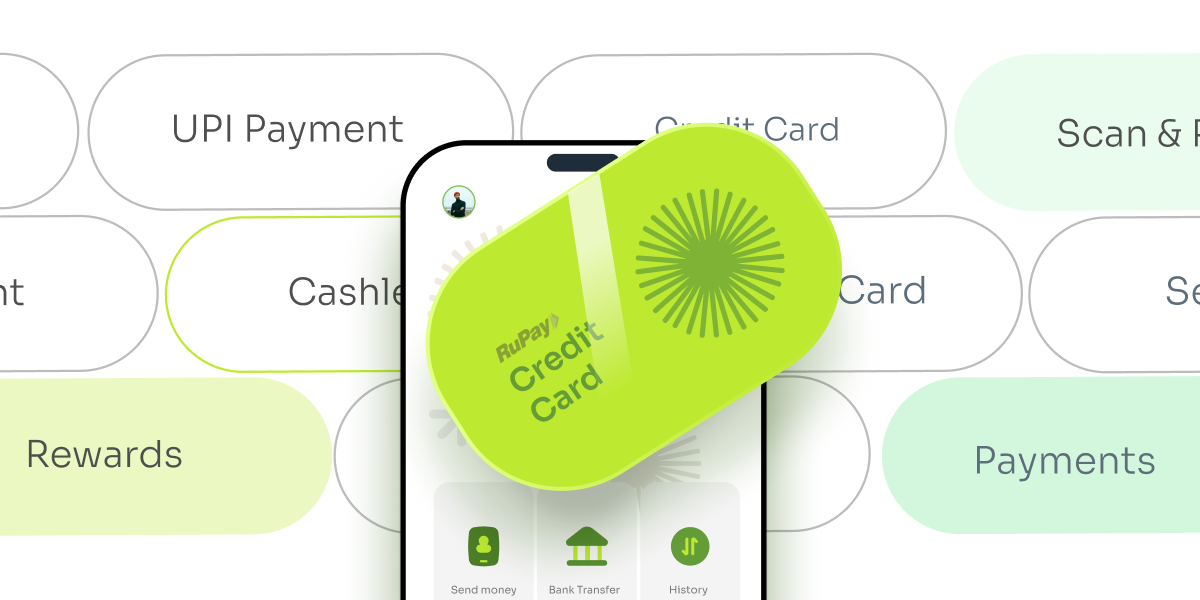

Jupiter Edge Rupay Credit Card Affiliate Program: Easy to Convert!

The Jupiter Edge RuPay Credit Card is one of the best in the Indian credit card market due to its focus on digital convenience, rewards tailored for everyday spending, and a seamless experience that appeals to digital-first users. Thus, the Jupiter Edge Rupay Credit Card Affiliate Program is top-notch!

From application to usage, the Jupiter Edge RuPay Credit Card operates through the Jupiter app, providing a seamless, paperless experience. Moreover, Rewards earned with the Jupiter Edge card don’t expire!

Commission Rates

| Jupiter Credit Card Variant | Commission Rate per Acquisition (CPA) |

| Jupiter Edge Rupay | ₹712.50 |

Affiliate Campaign Details

| 3 Months EPC | ₹1.18 |

| Affiliate Campaign Type | CPA |

| Cookie Duration | NA |

| Validation Rate | NA |

| Country | India |

| Tracking | Online |

| Validation Criteria | Successful credit card Application via the Jupiter App |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Banner | Yes |

This RuPay Credit Card comes with no joining or annual fees, making it an attractive option for budget-conscious users who want rewards without incurring extra charges. Also, with Rupay in demand in India due to UPI-on-credit and attractive offers, the Jupiter Edge Rupay Credit Card Affiliate Program is amazingly beneficial to market.

Another unique aspect here is its Insights and Tips on Savings via budgeting tools, encouraging cardholders to make financially sound decisions.

KTC Credit Card Affiliate Program: Strong Reputation

The KTC (Krungthai Card) Credit Card Affiliate Program in Thailand provides affiliates with opportunities to promote one of Thailand’s leading credit card brands, Krungthai Card Public Company Limited (KTC).

KTC is a well-established credit card provider with a strong reputation in Thailand. The brand offers numerous card options with a variety of rewards, making it easier for affiliates to promote and convert.

KTC’s credit cards come with a variety of perks tailored for Thai residents, such as discounts at local restaurants, retail stores, and travel deals, which align well with the spending patterns of the local population.

Commission Rates

| KTC Credit Card Variant | Commission Rate per Lead (CPL) |

| KTC Credit Card | ₹569.16 |

Affiliate Campaign Details

| 3 Months EPC | ₹0.94 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | 30 days |

| Validation Rate | NA |

| Country | Thailand |

| Tracking | Online |

| Validation Criteria | Successful credit card dispatch |

| Tracking Time | 5 mins |

| Validation Time | 15 days from following month |

| Payment Time | 40 days after Validation |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | Yes |

| Incentive/Cashback | No |

| Social Media | Yes |

| Deals & Coupons | No |

They are known for attractive benefits like cashback, installment payment options, and reward points, which make them appealing to a wide demographic, from young professionals to families and frequent travelers.

KTC frequently runs special promotions, such as bonus points, cashback offers, and exclusive deals, which affiliates like you can leverage to attract new customers and boost conversions. Deals & Coupons are currently not allowed but are expected to resume soon!

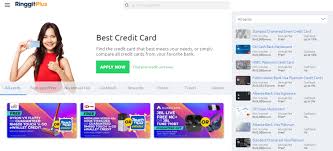

RinggitPlus Credit Card Affiliate Program: 5+ Banks!

The RinggitPlus Credit Card Affiliate Program is a popular affiliate option in Malaysia, allowing partners to earn by promoting various credit cards from major banks in the region. RinggitPlus is one of Malaysia’s leading financial comparison websites, known for helping users find and compare credit cards, loans, and insurance products.

RinggitPlus partners with top Malaysian banks like Maybank, CIMB, HSBC, and others, offering a broad selection of credit cards. This variety allows affiliates to cater to different consumer needs, from cashback and rewards cards to travel and premium credit cards.

Commission Rates

| Credit Card Platform | Commission Rate per Lead (CPL) |

| RinggitPlus (except HSBC Amanah MPower Platinum Credit Card-i) | Income above MYR3,000: ₹184.98 (Standard Chartered, HSBC Bank), ₹138.31 (UOB, Alliance, AEON, RHB Bank), ₹92.20 (Public Bank) | Income below MYR3,000: ₹46.10 (all banks mentioned above) |

RinggitPlus Credit Card Affiliate Campaign Details

| 3 Months EPC | NA |

| Affiliate Campaign Type | CPL |

| Cookie Duration | 30 days |

| Validation Rate | NA |

| Country | Malaysia |

| Tracking | Online |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | Yes |

| Social Media | Yes |

| Deals | Yes |

| Coupons | No |

RinggitPlus credit card affiliate program also provides a range of banners, links, and promotional content to make it easy for affiliates to start promoting the credit cards. These materials are professionally designed, reducing the affiliate’s need to create their own.

Bajaj Insta EMI Card Affiliate Marketing Program

The Bajaj Insta EMI Card Affiliate Marketing Program allows individuals and businesses to earn commissions by promoting the Insta EMI Card. This program enables affiliates to advertise Bajaj’s Insta EMI Card and drive users to sign up for it, earning commissions for each successful referral.

Affiliates are paid a commission for each new Insta EMI Card application and approval they generate. Approval target point is KYC so make a note.

Commission Rates

| Credit Card Variant | Commission Rate per Lead (CPL) |

| Bajaj Insta EMI Card | ₹180 |

Affiliate Campaign Details

| 3 Months EPC | ₹1.01 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | 1 day |

| Validation Rate | 100% |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Banners | Yes |

The Insta EMI Card appeals to a broad market since it is widely accepted in many stores and allows EMI-based purchases without a credit card. Additionally, Affiliates benefit from Bajaj’s brand reputation, making it easier to attract interested users.

Kiwi Cards CPA Affiliate Program: High Commission & Conversion

Kiwi Cards CPA Affiliate Program is the highest converting one in this list with a 3 Months EPC of ₹139.43! Its commission rate is also pretty high, nearly touching the 1500-mark!

Commission Rates

| Credit Card Variant | Commission Rate per Lead (CPI & CPA) |

| Kiwi Rupay | ₹1,485 |

Affiliate Campaign Details

| 3 Months EPC | ₹139.43 |

| Affiliate Campaign Type | CPI & CPA |

| Cookie Duration | 7 days |

| Validation Rate | NA |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Download & Install App, Apply, Approved, and Successful credit card dispatch (virtual) |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

Note: only Kiwi Card new user transactions are eligible

You can highlight key Kiwi Card rewards like lifetime free card, min 2% cashback on scan & pay, flat 5% cashback on ₹1.5 Lakh yearly spends, ₹200 fuel cashback, and scan now & pay later. Besides, all your Kiwi reward points go directly into your bank account i.e. real money!

PopCard (by YesBank) Affiliate Program

PopCard gives rewards on many popular online platforms, some of which are Zomato, Blinkit, Cleartrip, Rapido, CultFit, and Pharmeasy. Additionally, there are no joining fees (₹399 annual fee | waived off on ₹1.5 Lakh annual spends) and ₹5000 worth welcome bonus. Thus, the PopCard Affiliate Program can get you good conversions. Besides, you can get it better by providing cashback/incentive offers.

Commission Rates

| Credit Card Variant | Commission Rate per Lead (CPL) |

| PopCard | ₹900 |

Affiliate Campaign Details

| 3 Months EPC | ₹37.9 |

| Affiliate Campaign Type | CPL |

| Cookie Duration | NA |

| Validation Rate | NA |

| Country | India |

| Tracking | Offline |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | Yes |

| Social Media | No |

| Deals & Coupons | No |

UOB Credit Card Affiliate Program

The UOB Credit Card Thailand Affiliate Program offers compelling benefits for affiliates due to the popularity and variety of UOB credit cards, which are tailored to diverse spending habits.

Affiliates earn commissions for each successful UOB World credit card application, which can add up due to Thailand’s high credit card adoption rate, especially for rewards-rich cards.

Commission Rates

| Credit Card Variant | Commission Rate per Lead (CPL) |

| UOB World credit card | ₹285.05 |

Affiliate Campaign Details

| 3 Months EPC | NA |

| Affiliate Campaign Type | CPL |

| Cookie Duration | NA |

| Validation Rate | NA |

| Country | Thailand |

| Tracking | Online |

| Validation Criteria | Successful credit card dispatch |

| Missing Transactions Accepted | No |

Allowed/Disallowed Promotions

| Deeplink | No |

| Incentive/Cashback | No |

| Social Media | No |

| Deals & Coupons | No |

| Banner | Yes |

UOB is a trusted brand in Thailand’s financial sector, which helps build credibility and ease for affiliates in their promotions, increasing the likelihood of conversions.

Therefore, these best credit card affiliate programs provide affiliates with a lucrative and flexible way to generate income by promoting a highly sought-after financial product. These programs stand out due to their high commission rates, diverse card offerings, and strong market demand. Affiliates can earn competitive payouts by promoting cards from reputable financial institutions, which in turn attract customers with enticing rewards, cashback, and travel perks. With robust tracking tools, detailed analytics, and ongoing support, top credit card affiliate programs empower affiliates to reach targeted audiences, maximize conversions, and earn sustainable income. Ultimately, credit card affiliate programs offer a compelling blend of profitability, market appeal, and scalability, making them an ideal choice for both new and experienced affiliates in the finance sector.

Sahil Ajmera is content writer with more than 7 years of work experience in field of Affiliate Marketing, Digital Marketing, etc. He loves saving money on everything. His aim is to get readers exactly what they are looking for and that too without wasting much of their time. Whatever he is writing on, you are sure to find a way to earn & save good!